Syndicated Loans Global Market Report 2024 – Market Size, Trends, And Market Forecast 2024-2033

The Business Research Company’s Syndicated Loans Global Market Report 2024 – Market Size, Trends, And Market Forecast 2024-2033

— The Business Research Company

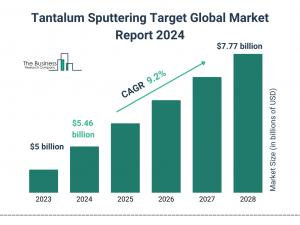

LONDON, GREATER LONDON, UNITED KINGDOM, October 11, 2024 /EINPresswire.com/ — The syndicated loans market size has also grown quickly in recent years. It is expected to increase from $1,067.23 billion in 2023 to $1,201.24 billion in 2024, achieving a CAGR of 12.6%. The growth drivers include economic expansion, corporate mergers and acquisitions, credit market conditions, global trade dynamics, and bank capital and liquidity.

What Is The Estimated Market Size Of The Global Syndicated Loans Market And Its Annual Growth Rate?

The syndicated loans market size is projected to grow rapidly in the next few years, reaching $1935.96 billion by 2028 at a CAGR of 12.7%. This growth can be attributed to interest rate trends, environmental, social, and governance (ESG) factors, global trade and investment flows, investor demand for yield, and geopolitical stability. Key trends include increasing demand for infrastructure financing, expansion in emerging markets, involvement of private equity, sector-specific growth, and improved risk management practices.

Explore Comprehensive Insights Into The Global Syndicated Loans Market With A Detailed Sample Report:

Growth Driver Of The Syndicated Loans Market

The increasing demand for large loans is anticipated to spur the growth of the syndicated loan market in the future. Large loans represent substantial amounts borrowed by individuals or organizations, typically for significant investments or projects. The demand for these loans is rising due to expanding business operations and substantial investments in infrastructure and real estate. Syndicated loans help facilitate large loans by pooling resources from multiple lenders, thereby distributing risk and providing significant capital to borrowers.

Make Your Report Purchase Here And Explore The Whole Industry’s Data As Well:

Who Are The Leading Competitors In The Syndicated Loans Market Share?

Key players in the market include JPMorgan Chase & Co, Banco Santander S.A, Bank of China, BNP Paribas SA, ING Group N.V., Mitsubishi UFJ Financial Group Inc., Barclays PLC, State Bank of India, Sumitomo Mitsui Banking Corporation, Deutsche Bank AG, UniCredit S.p.A., Mizuho Financial Group Inc., Apollo Global Management Inc., Standard Bank Group Limited, Union Bank of India, Macquarie Bank Limited, Stifel Financial Corp., Ares Management Corporation, Toronto Dominion Securities, Houlihan Lokey Inc., Credit Agricole CIB, Brookfield Asset Management Inc., BMO Capital Markets, William Blair & Company, Bank Handlowy w Warszawie S.A., Acuity Knowledge Partners.

What Are The Dominant Trends In Syndicated Loans Market Growth?

Companies in the syndicated loan market are developing advanced syndicated loan trading solutions that offer real-time data, analytics, and streamlined trading protocols on a single platform. These solutions facilitate the buying and selling of syndicated loans among financial institutions and investors, meeting a growing need for efficient loan trading systems.

How Is The Global Syndicated Loans Market Segmented?

1) By Type: Term Loan, Revolving Loan, Underwritten Transactions, Other Types

2) By Use of Proceeds: Working Capital, Acquisition Financing, Project Finance, Other Use of Proceeds

3) By Industry Vertical: Financials Services, Energy and Power, High Technology, Industrials, Consumer Products and Services, Other Industry Verticals

Geographical Insights: North America Leading The Syndicated Loans Market

North America was the largest region in the market in 2023. The regions covered in the report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Syndicated Loans Market Definition

Syndicated loans are provided by a group of lenders, or syndicates, who collaboratively offer funds to a single borrower. This model disperses risk among multiple financial institutions and facilitates significant funding for corporate financing needs, such as mergers, acquisitions, or large capital expenditures.

Syndicated Loans Global Market Report 2024 from The Business Research Company covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global syndicated loans market report covering trends, opportunities, strategies, and more

The Syndicated Loans Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on syndicated loans market size, syndicated loans market drivers and trends, syndicated loans market major players and syndicated loans market growth across geographies. This report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Loan Origination Software Global Market Report 2024

Personal Loans Global Market Report 2024

Broadcast Automation Software Global Market Report 2024

What Does the Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

[email protected]

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Article originally published on www.einpresswire.com as Syndicated Loans Market Size, Share, Revenue, Trends, and Drivers For 2024-2033