— Rob Sturms

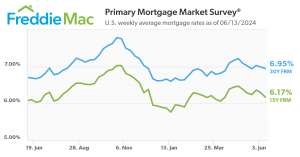

DENVER, COLORADO, UNITED STATES, June 14, 2024 /EINPresswire.com/ — As per the latest Freddie Mac Primary Mortgage Market Survey®, the U.S. housing market is experiencing a welcome decline in mortgage rates, with the 30-year fixed-rate mortgage (FRM) and 15-year FRM both continuing their downward trend this week.

This recent reduction in rates comes as part of an ongoing shift towards a more balanced economic growth, as indicated by the latest economic data. Despite overall inflation numbers remaining stable, shelter inflation has seen an uptick, underscoring the ongoing challenges in housing affordability. This is particularly relevant for individuals in the market for new homes, where lower mortgage rates could provide a significant financial breather.

As of June 13, 2024, the 30-year FRM stands at 6.95%, marking a slight decrease from the previous week, and showing a stabilization within the year’s range of 6.6% to 7.79%. Meanwhile, the 15-year FRM is now at 6.17%, continuing its descent to more attractive levels for shorter loan terms, and remaining within its annual range of 5.76% to 7.03%.

These declining rates present a unique opportunity for prospective homeowners to secure financing at more favorable terms, in a market that has been challenging for many. Rob’s Mortgage Loans, a trusted name in mortgage advisory services, emphasizes the importance of accurate, timely advice in navigating these shifts.

Rob Sturms, Founder of Rob’s Mortgage Loans, states, “The current downtrend in mortgage rates could be a significant advantage for homebuyers looking to enter the market or for homeowners considering refinancing. Our team is dedicated to providing expert guidance to ensure our clients make the most informed decisions tailored to their financial needs.”

For those contemplating the purchase of a new home or refinancing their current mortgage, now may be an opportune time to explore options with an experienced mortgage broker that could lead to substantial savings over the life of a loan.

About Rob’s Mortgage Loans

Rob’s Mortgage Loans has been at the forefront of mortgage advice in Denver, Colorado for over a decade, helping clients navigate the complexities of home financing with ease and expertise. Whether you’re a first-time buyer or looking to refinance, Rob’s team ensures you get the best deal suited to your financial situation.

For personalized mortgage advice and to learn more about how these rates affect you, visit Rob’s Mortgage Loans at www.robsmortgageloans.com.

Opinions, estimates, forecasts, and other views contained in this document are those of Freddie Mac’s economists and other researchers, do not necessarily represent the views of Freddie Mac or its management, and should not be construed as indicating Freddie Mac’s business prospects or expected results. Although the authors attempt to provide reliable, useful information, they do not guarantee that the information or other content in this document is accurate, current or suitable for any particular purpose. All content is subject to change without notice. All content is provided on an “as is” basis, with no warranties of any kind whatsoever. Information from this document may be used with proper attribution. Alteration of this document or its content is strictly prohibited.

Rob Sturms

Rob’s Mortgage Loans

email us here

Visit us on social media:

Facebook

LinkedIn

![]()

Article originally published on www.einpresswire.com as Robust Decline in Mortgage Rates Signals Opportunities for Prospective Homebuyers