Which are the cheapest cars to insure in the UK?

The car insurance experts at NimbleFins researched car insurance rates for cars with a low insurance group to find which are cheapest to insure.

— Erin Yurday

LONDON, UNITED KINGDOM, October 3, 2024 /EINPresswire.com/ — The car insurance experts at NimbleFins researched car insurance rates for cars with a low insurance group to find which are cheapest to insure.

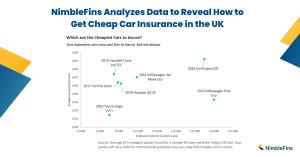

To help UK motorists find the cheapest cars to insure, the NimbleFins team has compared car insurance rates for seven used vehicles ranging in value from £8,000 to £19,000, including popular models from Ford, Kia, Toyota, Hyundai, Volkswagen, and Vauxhall.

For these vehicles, insurance premiums for a sample driver aged 30 ranged from £529 up to £664 per year. Of these, the cheapest car to insure was the 2013 Toyota Aygo, which also had the lowest market value (£8,000). Of newer cars, the 2023 VW Polo was the cheapest to insure despite the higher vehicle market value (£19,000), coming in at £566 per year to insure for the sample driver.

Here are the basic vehicle details and the average of the five cheapest car insurance rates found for each:

– 2013 Toyota Aygo VVT-i: £529

– 2023 Volkswagen Polo Evo: £566

– 2019 Hyundai i10 SE: £605

– 2017 Ford Ka Zetec: £608

– 2016 Volkswagen Up! Move Up!: £620

– 2019 Vauxhall Corsa ecoTEC: £628

– 2023 Kia Picanto DPi: £664

Cars that are cheaper to insure often have lower market values, because the market value of a car limits the maximum claim payout for accident repair, fire damage, or theft of the vehicle. But there are other factors contributing to the cost of car insurance as well.

Erin Yurday, the CEO and Founder of NimbleFins, said: “A car with a lower market value is often cheaper to insure, but not always because insurance pricing models reflect other vehicle-related factors such as engine size, theft rates, and repair costs. For example, NimbleFins market tests showed that a 2016 VW Up! valued at £10,900 cost more to insure than a 2023 VW Polo valued at £19,000. This is surprising because a vehicle theft claim would be much more expensive for the Polo due to its higher market value. Insurers must have experience of higher claims costs with the Up!”

Some competing comparison sites have reported that Porsche Boxsters are amongst the cheapest cars to insure, but this is highly misleading. If the comparison site data shows that these cars have cheaper insurance rates, it’s likely because they are being driven by drivers in lower-risk age brackets or living in safer areas, for example, not because the car is amongst the cheapest to insure for any given driver.

NimbleFins provides a car insurance comparison for UK motorists to find cheap car insurance, where they also have developed a new, data-driven car insurance scorecard and used this to rank 10 large UK insurance providers across desirable features like ease of communicating with customer support and canceling a policy. This information is important so motorists understand what they are getting when buying a car insurance policy.

Erin Yurday

NimbleFins Limited

email us here

Visit us on social media:

X

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Article originally published on www.einpresswire.com as NimbleFins Analyzes Data to Reveal How to Get Cheap Car Insurance in the UK