Mobile Money Global Market Report 2024 – Market Size, Trends, And Market Forecast 2024-2033

The Business Research Company’s Mobile Money Global Market Report 2024 – Market Size, Trends, And Market Forecast 2024-2033

— The Business Research Company

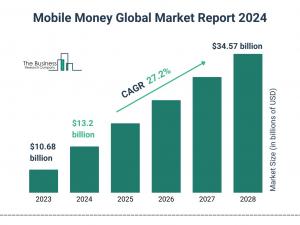

LONDON, GREATER LONDON, UNITED KINGDOM, October 21, 2024 /EINPresswire.com/ — The mobile money market has experienced robust growth in recent years, expanding from the market is projected to grow from $10.68 billion in 2023 to $13.2 billion in 2024, reflecting a compound annual growth rate (CAGR) of 23.5%. This historic growth can be linked to factors such as increased mobile penetration and connectivity, initiatives aimed at financial inclusion, supportive government regulations, the rise of mobile banking and payment systems, enhanced user convenience and accessibility, and measures to build security and trust.

What Is The Estimated Market Size Of The Global Mobile Money Market And Its Annual Growth Rate?

The mobile money market is projected to continue its strong growth, reaching the market is expected to reach $34.57 billion by 2028, growing at a compound annual growth rate (CAGR) of 27.2%. This anticipated growth can be attributed to the development of cross-border mobile money solutions, improvements in user experience, tailored services for various demographics, expansion into new geographic regions, a focus on user education and awareness, and increasing integration with e-commerce platforms.

Explore Comprehensive Insights Into The Global Mobile Money Market With A Detailed Sample Report:

Growth Driver of The Mobile Money Market

The rising popularity of the growing e-commerce industry is expected to boost the growth of the mobile money market. E-commerce refers to the buying and selling of goods and services over the internet. Mobile money solutions are increasingly being used to facilitate secure and convenient payments for e-commerce transactions. Mobile money solutions offer several advantages over traditional payment methods, including ease of use, accessibility, and security.

Explore The Report Store To Make A Direct Purchase Of The Report:

Which Market Players Are Driving The Mobile Money Market Growth?

Key players in the market include Vodafone Group plc, Google LLC, Orange S. A., Fidelity National Information Services Inc., PayPal Holdings Inc., Mastercard Incorporated, Fiserv Inc., Bharti Airtel Limited, Ant Group Co. Ltd., MTN Group Limited, Paytm Payments Bank Limited, Samsung Electronics Co. Ltd., Visa Inc., Tencent Holdings Limited, Global Payments Inc., Square Inc., Amazon. com Inc., Apple Inc., The Western Union Company, Comviva Technologies Limited, T-Mobile US Inc., Obopay Inc., FTS Group Inc., Peerbits Solution Pvt. Ltd., Panamax Inc., Alepo Technologies Inc., Econet Wireless, Millicom International Cellular S. A., Airtel Limited, Safaricom

What Are The Key Trends That Influence Mobile Money Market Share Analysis?

Major players in the mobile money market are forming strategic partnerships to create opportunities for individuals and businesses throughout the continent. These partnerships involve companies leveraging each other’s strengths and resources to achieve mutual benefits and success.

How Is The Global Mobile Money Market Segmented?

1) By Transaction Type: Person to Person (P2P), Person to Business (P2B), Business to Person (B2P), Business to Business (B2B)

2) By Payment: Remote Payments, Proximity Payments

3) By Application: Bill Payments, Money transfers, Recharge & Top-up, Ticket Payment, Other Applications

Geographical Insights: North America Leading The Mobile Money Market

Asia-Pacific was the largest region in the market in 2023. The regions covered in the report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Mobile Money Market Definition

Mobile money refers to the electronic transfer of funds between individuals or entities through mobile devices. This digital payment technology is integrated into devices and can be accessed on standard smartphones to send, withdraw, and receive money without relying on traditional banking systems. Mobile money serves as a secure and convenient alternative to bank accounts.

Mobile Money Global Market Report 2024 from The Business Research Company covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global mobile money market report covering trends, opportunities, strategies, and more

The Mobile Money Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on mobile money market size, mobile money market drivers and trends, mobile money market major players and mobile money market growth across geographies. This report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Payments Global Market Report 2024

Payment Security Global Market Report 2024

Cards & Payments Global Market Report 2024

What Does the Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

[email protected]

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Article originally published on www.einpresswire.com as Global Mobile Money Market Overview And Statistics For 2024-2033