Banking Customer Relationship Management (CRM) Software Global Market Report 2024 – Market Size, Trends, And Global Forecast 2024-2033

The Business Research Company’s Banking Customer Relationship Management (CRM) Software Global Market Report 2024 – Market Size, Trends, And Forecast 2024-2033

— The Business Research Company

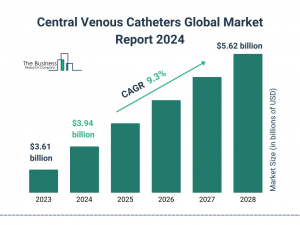

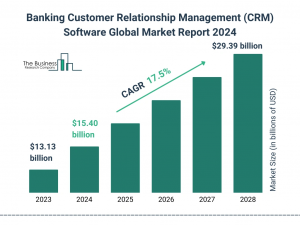

LANDON, GREATER LANDON, UNITED KINGDOM, September 17, 2024 /EINPresswire.com/ — The banking customer relationship management (CRM) software market has experienced robust growth in recent years, expanding from $13.13 billion in 2023 to $15.40 billion in 2024 at a compound annual growth rate (CAGR) of 17.3%. The growth in the historic period can be attributed to increasing demand for self-service banking, increasing demand for automated customer insights software, increasing demand for cloud solutions, increasing demand by funding research and development initiatives, and rising desire for improved customer service.

What Is The Estimated Market Size Of The Global Banking Customer Relationship Management (CRM) Software Market And Its Annual Growth Rate?

The banking customer relationship management (CRM) software market is projected to continue its strong growth, reaching $29.39 billion in 2028 at a compound annual growth rate (CAGR) of 17.5%. The growth in the forecast period can be attributed to rising product demand from small and medium-sized businesses, growing, competitors in the customer relationship management (CRM) software industry, increasing use of internet banking, increasing digitalization of the banking sector, and rising popularity of mobile banking

Explore Comprehensive Insights Into The Global Banking Customer Relationship Management (CRM) Software Market With A Detailed Sample Report:

Growth Driver Of The Banking Customer Relationship Management (CRM) Software Market

The growing online banking services are expected to propel the growth of the banking customer relationship management (CRM) software market going forward. Online banking is a convenient and efficient way for customers to manage their finances and perform various banking transactions electronically through their bank’s secure online platform. The prominence of online banking is rising due to convenience, security, and easy access to a wide range of financial services. The banking CRM software manages and analyzes customer interactions and data across digital channels, providing enhanced customer service, personalized experiences, and improved operational efficiency.

Make Your Report Purchase Here And Explore The Whole Industry’s Data As Well:

Which Market Players Are Steering the Banking Customer Relationship Management (CRM) Software Market Growth?

Key players in the banking customer relationship management (CRM) software market include Microsoft Corporation, Oracle Corporation, Salesforce Inc., Fiserv Inc., Infor Global Solutions, Sage Group, Genesys Cloud Services Inc., HubSpot Inc., Zoho Corporation, Pegasystems Inc., Temenos AG, Acidaes Solutions Private Limited (CRMNEXT), Creatio, SAP SE, Doxim Inc., SugarCRM Inc., Kapture CX, NexJ Systems Inc., Leadsquared Inc., Claritysoft LLC, Liferay Inc.

What Are the Dominant Trends in Banking Customer Relationship Management (CRM) Software Market Overview?

Major companies operating in the banking customer relationship management (CRM) software market are integrating artificial intelligence (AI) to enhance the efficiency of transaction dispute management for banks. Integrating artificial intelligence (AI) into transaction dispute management can significantly boost efficiency for banks by automating the detection and resolution of disputes. AI algorithms analyze transaction data to identify patterns and anomalies, enabling quicker and more accurate identification of fraudulent activities or errors.

How Is The Global Banking Customer Relationship Management (CRM) Software Market Segmented?

1) By Offering: Solution, Services

2) By Deployment Mode: On-Premises, Cloud

3) By Application: Customer Service, Customer Experience Management, Customer Relationship Management (CRM) Analytics, Marketing Automation, Salesforce Automation, Other Applications

Geographical Insights: North America Leading The Banking Customer Relationship Management (CRM) Software Market

North America was the largest region in the banking customer relationship management (CRM) software market in 2023. The regions covered in the banking customer relationship management (CRM) software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Banking Customer Relationship Management (CRM) Software Market Definition

Banking customer relationship management (CRM) software is a specialized system designed to help financial institutions manage their interactions with current and potential customers. This software enables banks to streamline and enhance customer service, improve customer retention, and drive sales growth by centralizing and analyzing customer data.

Banking Customer Relationship Management (CRM) Software Global Market Report 2024 from TBRC covers the following information:

• Market size data for the forecast period: Historical and Future

• Macroeconomic factors affecting the market in the short and long run

• Analysis of the macro and micro economic factors that have affected the market in the past five years

• Market analysis by region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• Market analysis by countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

An overview of the global banking customer relationship management (CRM) software market report covering trends, opportunities, strategies, and more

The Banking Customer Relationship Management (CRM) Software Global Market Report 2024 by The Business Research Company is the most comprehensive report that provides insights on banking customer relationship management (CRM) software market size, banking customer relationship management (CRM) software market drivers and trends, banking customer relationship management (CRM) software market major players, banking customer relationship management (CRM) software competitors’ revenues, banking customer relationship management (CRM) software market positioning, and banking customer relationship management (CRM) software market growth across geographies. The banking customer relationship management (CRM) software market report helps you gain in-depth insights into opportunities and strategies. Companies can leverage the data in the report and tap into segments with the highest growth potential.

Browse Through More Similar Reports By The Business Research Company:

Banking, Financial Services and Insurance (BFSI) Security Global Market Report 2024

Banking Hardware Maintenance, Software Support And Helpdesk Support Services Global Market Report 2024

Neobanking Global Market Report 2024

What Does The Business Research Company Do?

The Business Research Company publishes over 15,000 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package, and much more.

Our flagship product, the Global Market Model, is a premier market intelligence platform delivering comprehensive and updated forecasts to support informed decision-making.

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

[email protected]

Visit us on social media:

Facebook

X

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()

Article originally published on www.einpresswire.com as Global Banking Customer Relationship Management (CRM) Software Market Size, Share And Growth Analysis For 2024-2033